DCSA employees are hired into positions in the GG grade structure and compensated under the Defense Civilian Intelligence Personnel System (DCIPS). Salaries include base pay and a local market supplement, and are the same as the locality area pay tables for Federal General Schedule (GS) grades and steps. Most employees have salaries that start at step 1 of the position’s grade. Employees move up the 10-step range of a grade by completing waiting periods: one year each for steps 2 through 4, two years for steps 5 through 7, and three years for steps 8 through 10.

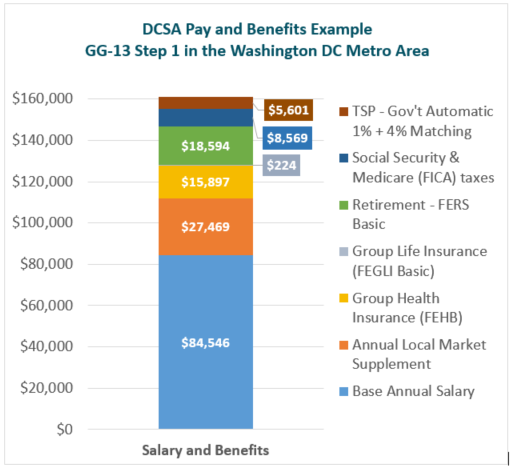

DCSA makes significant employer payments for major employee benefits, such as health insurance, basic life insurance, and retirement. For example, a GG-13 step 1 employee in the Washington DC metro area earns $112,015 in annual salary. With an additional $48,886 paid by DCSA for benefits, the total value to the employee is $160,901.