Providing Valid Financial Codes and Agency Identifiers

Customer agencies are required to ensure that accurate Submitting Office Number (SON), Security Office Identifier (SOI), Agency Location Code (ALC), Obligating Document Number (FS Form 7600B Buyer Order Tracking Number or G-invoicing Order Number), and any other internally required billing information are provided during the initial investigative submission to DCSA.

Submitting Office Number (SON)

The SON is required to investigative requests. DCSA assigns a unique four-character alphanumeric code, known as the Submitting Office Number (SON), to each office that requests investigations from DCSA. The SON identifies the office that initiates the investigation and is recorded in the appropriate Agency Use Block (AUB) of the standard form.

Security Office Identifier (SOI)

The SOI is required for all investigative requests. Each security office is issued a unique alphanumeric four-character identifier from DCSA, the Security Office Identifier (SOI), which is used to identify the appropriate agency official who will receive case results, data, or other information from DCSA.

Agency Location Code (ALC)

The ALC is required for all investigative requests. This code comes from the FS Form 7600B (Field 6 – Buyer Agency Location Code). The ALC is assigned to your agency by the U.S. Department of Treasury. The ALC is used within the IPAC system and supports a standardized interagency fund transfer mechanism for Federal Program Agencies (FPAs). Billing activity is summarized monthly and issued to the buyer ALC.

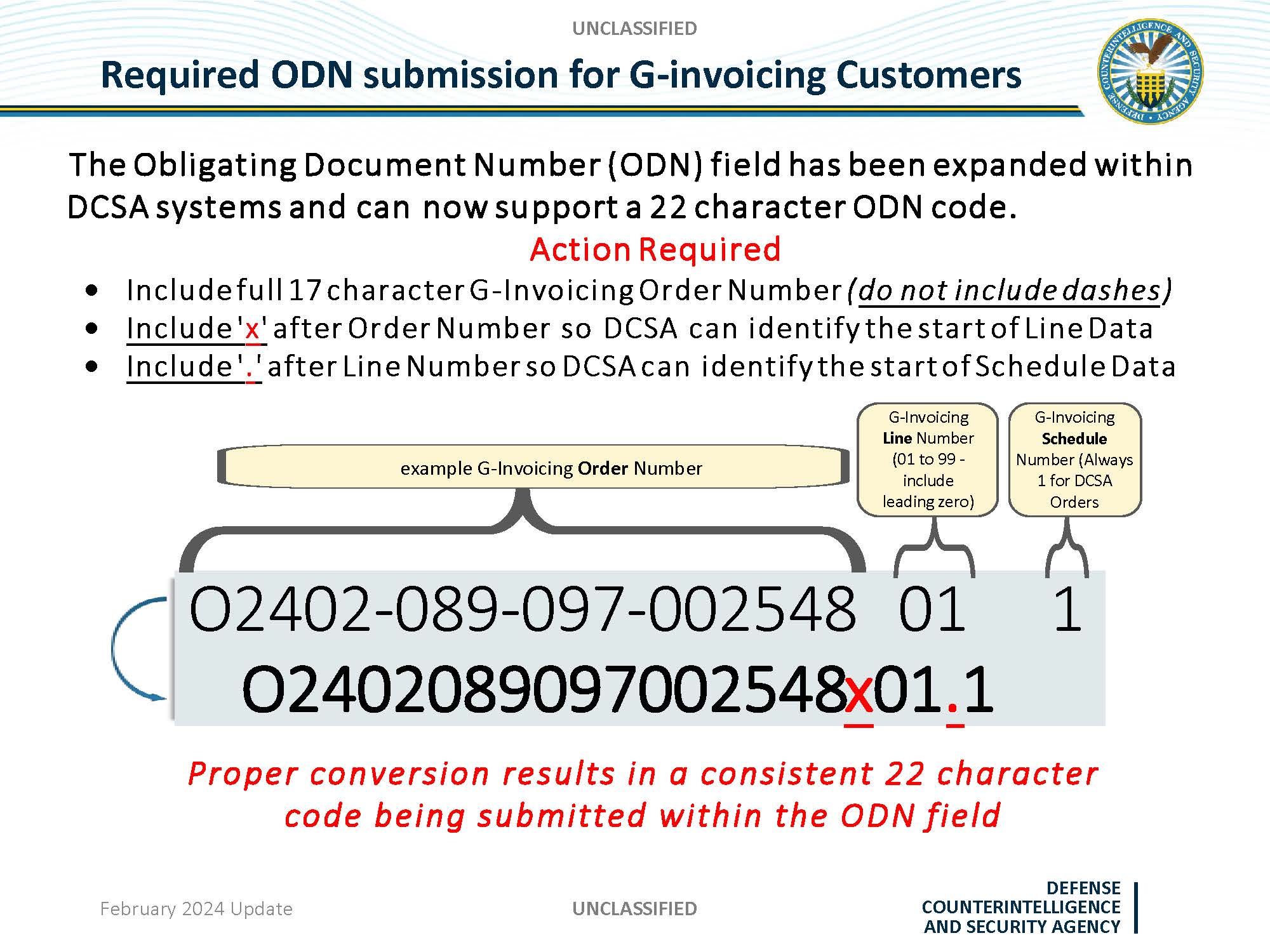

Obligating Document Number (ODN)

The ODN is required for all investigative requests (22-character limit). This code comes from the FS Form 7600B (Field 1 – Buyer Order Tracking Number) or is your G-Invoicing Order Number. The value provided in the Obligating Document Number field is critical and allows DCSA to apply the associated charges against a current and valid funding agreement.

Treasury Account Symbol (TAS)

The TAS is used to identify the submitting agencies fund account that will be used to pay for the requested background investigation. DCSA will invoice to the TAS identified and agreed-to within the associated customer agency’s established funding document(s). If the TAS field is populated during the initial case submission process, it can assist DCSA with identifying the appropriate funding document to invoice against if a valid ODN is not provided.

Accounting Data and/or Agency Case Number

The accounting data field is an optional field (25-character limit). This block can be used by the requesting agency to note any information that the agency needs for its own internal processes, such as an internal case number, line of accounting, or any other specific agency identifier. This field will appear on your monthly invoice and can be useful for internal invoice reconciliation.

Cost

The FY 2024 cost of an electronic fingerprint-only Special Agreement Check (SAC) is $20.

Special note on electronic fingerprint - only case submissions made to DCSA Fingerprint submissions must be sent to DCSA before requesting an associated higher-level investigation that requires fingerprints. Special Agreement Check (SAC) results can be used (and have historically been used by some agencies) to satisfy fingerprint requirements for a higher-level investigation request for up to 120 days.

DCSA Billing Policy for Electronic Fingerprint- only SAC

When an electronic fingerprint-only SAC is submitted, DCSA will hold off on billing for 120 days. If a higher-level case is submitted, the agency will not receive a separate bill for the SAC. As a result, the higher-level case will also no longer receive a corresponding fingerprint SAC credit. If no higher-level case is submitted within 120 days, the SAC will be billed to the agency as a standalone charge.

For there to not be a separate charge for fingerprints, the agency must:

-

Submit the eFP SAC at least one day, but no greater than 120 days in advance of the higher-level investigation

-

Include FIPC code "I" (letter i) on the higher-level investigation

Including Agency Specific Details within Fingerprint Submissions

Since not all electronic fingerprint machines contain an accounting field, the Attention Indicator, "ATN" field, can be used as an alternative method on most machines. Populated ATN field details will return in the "Accounting" field within the monthly invoices. This process can be used as an effective alternative to provide agency required accounting or requesting official contact details that are otherwise not commonly available with fingerprint submissions. Additionally, the Occupation, "OCP" field, can be used to return agency, requesting office, and/or subject specific identifiers. Populated OCP field details will return in the "POSITION" field on monthly invoices. Agencies using GSA shared enrollment (USAccess) centers may not have the ability to populate the ATN and OCP fields. Agencies using USAccess should address their concerns regarding this and/or issues with "missing" accounting details on their invoice(s) directly with GSA. The field requirements for the ATN field are: populated with greater than 3 characters; truncated at 30 characters; and cannot contain any dot or "special" characters. The only field requirement for the OCP field is that it will be truncated at 50 characters.

Unclassifiable Fingerprints

Requirements for Submitting Reprints when Prints are Unclassifiable. When the FBI is unable to make a classifiable determination due to illegible fingerprints, the FBI deems the submissions as "Unclassifiable". A reprint may be submitted within one year of the case closing date to obtain a classifiable determination without incurring additional cost. The original case number of the unclassifiable fingerprint must be provided with the reprint submission to avoid the discontinuance of the reprint or an additional fingerprint processing charge. The original case number must be provided in the OCA block on the SF-87 or FD-258 hard card or in the tagged field 2.009 of the electronic transmission. When submitting a hard card, please note "Reprint" in the top left-hand corner and attach the Notice of Unclassifiable Fingerprints.

Customer agencies must provide accurate and financial codes and agency identifiers during the initial investigative submission to DCSA. This includes: Submitting Office Number (SON), Security Office Identifier (SOI), Agency Location Code (ALC), Obligating Document Number (FS Form 7600B Order Tracking Number), Line of Accounting, and any other internally required billing information.

|

Case Type Code

|

Case Type Name

|

|

92

|

SAC - Special Agreement Check

|

|

06

|

NAC - National Agency Check

|

|

63

|

T1 - Tier 1 Investigation

|

|

55

|

T2 - Tier 2 Investigation

|

|

56

|

T2R - Tier 2 Reinvestigation

|

|

64

|

T3 - Tier 3 Investigation

|

|

65

|

T3R - Tier 3 Reinvestigation

|

|

66

|

T4 - Tier 4 Investigation

|

|

67

|

T4R - Tier 4 Reinvestigation

|

|

70

|

T5 - Tier 5 Investigation

|

|

71

|

T5R - Tier 5 Reinvestigation

|

|

43

|

RSI - Reimbursable Suitability/Security Investigation

|

Active Bill Event Transaction Codes

|

AA

|

Manual addition made where other billing codes cannot be applied

|

|

AB

|

Adjustment made when a Bureau of Vital Statistics (BVS) item is added to a case as additional coverage

|

|

AC

|

Adjustment made when a case is cancelled/discontinued prior to completion

|

|

AD

|

Adjustment made for Processing Fee when Child Care cases add a State Criminal History Repository (SCHR) search as additional coverage (there may be an AD event for each search conducted)

|

|

AE

|

Adjustment made for each SCHR search made in states that charge additional fees (there may be an AE event for each search conducted)

|

|

AF

|

Adjustment made when an agency is exempt from the FBI User fee(s)

|

|

AO

|

Adjustment made for a Citizenship and Immigration Services Check (IMM) when a Spouse/Cohabitant National Agency Check is conducted on a SAC product

|

|

AP

|

Adjustment made when named-based searches of FBI Criminal and Investigative Files for subject spouses and/or cohabitants are conducted on lower level cases with Access Levels 3-5 (there may be an AP event for each search conducted, this is possible when a person has had multiple last names)

|

|

AR

|

Adjustment made when a National Credit Check (CRED) item is added to a case as additional coverage or is conducted on a SAC or T1 product

|

|

AS

|

Manual subtraction made where other billing codes cannot be applied

|

|

AT

|

Adjustment made when a case type is changed

|

|

AU

|

Adjustment made when a case type and/or service is upgraded

|

|

AV

|

Adjustment made when a case service is changed

|

|

AX

|

Adjustment made when the case type and service is changed

|

|

AY

|

Adjustment made for processing fee when a Bar Association License Checks is added as additional coverage or is conducted on a SAC product (there may be an AY event for each state search conducted)

|

|

AZ

|

Adjustment made for each Bar Association License Check in states that charge additional fees (there may be an AZ event for each search conducted)

|

|

B3

|

Adjustment related to a Triggered Enhanced Subject Interview (TESI) on a T2 or T3 investigation

|

|

B5

|

Adjustment made when an electronic fingerprint-only SAC does not link to a higher level investigation after 120 days

|

|

CL

|

Closing bill event code when the investigation is completed

|

|

DA

|

Manual addition made due to an agency dispute

|

|

DS

|

Manual subtraction made due to an agency dispute

|

|

EC

|

Adjustment made to credit T2S and T2RS cases when a subject interview is not required (or reverse)

|

|

IN

|

Surcharge for cases requiring international work

|

|

OR

|

The initial bill event on a case

|

|

RO

|

Adjustment made to reverse a discontinue adjustment when the case is reopened

|

|

R_

|

With few exceptions, the bill event for RSI products will begin with the letter ‘R’ followed by the corresponding RSI Code

|